An apparent revolution is underway in the use of cryptocurrencies and blockchain technology, with an increasing number of implementations and applications being built at an alarming pace. One of these is the use of cryptocurrencies for trading derivatives. A derivative is, in essence, a contract or product whose value is determined by the value of an underlying asset or asset class. Let’s take a look at Margex, a cryptocurrency exchange trading platform that allows users to trade long or short on Bitcoin and other cryptocurrencies with up to 100x leverage. Margex is an entirely anonymous and user-friendly platform that will enable users to short cryptocurrency with no hidden fees or commissions imposed on them. This in-depth guide will walk you through all of the methods and terminologies involved in crypto shorting with Margex in greater detail.

What does shorting crypto mean and how does it work?

Crypto shorting

Crypto shorting is simply a technique that allows traders to sell a cryptocurrency at a high price and then buy it at a lower price. To enter a short position, traders will need to borrow cryptocurrencies from a broker and then sell them on an exchange at the current price of the cryptocurrency. The trader’s only responsibility is to wait for the cryptocurrency’s price to fall and repurchase it in order to repay the broker.

For example

For example, Bitcoin is currently trading at $42,000 on the open market. Suppose a trader predicts that the price of bitcoins will fall dramatically in the near future to $30,000. All they have to do is borrow bitcoin from a broker at the present market price and sell them on an exchange. After that, there is a period of waiting. If the price decreases as forecasted, the trader purchases at the lower price and then returns the borrowed cryptocurrency to the broker. Though this technique may not be appealing to all crypto traders, those who are willing to put their money at risk to profit from a successful price prediction against their chosen cryptocurrency stand to earn.

Longing crypto

Longing crypto is the complete opposite of shorting. It involves purchasing cryptocurrency at a cheaper price and holding onto it to sell it at a higher price.

Why should you short crypto with Margex?

With the easiest-to-use UI in the industry, Margex offers a broad range of powerful tools to harness your trading and boost profits. This is why the trading platform has been nominated by Finance Magnates as one of the top crypto margin trading exchanges. According to Finance Magnates, Margex is the easiest platform for trading derivatives. Some key advantages of Margex include.

Balance Protection

Negative balance protection ensures that your total account balance never stays below zero.

Price Manipulation Protection

Margex has the MP Shield™ System in place to protect clients from the drawbacks of price manipulation and unfair liquidations.

Cross Collaterals

Trade all available pairs without the need to own any of the underlying assets. Settle trades on all pairs in your chosen collaterals

No Entry Barrier

Minimum deposit of $10, and a minimum trading order size of $1

No hidden commissions

All fees paid are on-display in your live orders. Margex gives you honest RoE and PnL calculations in real time.

Variety of Deposit Options

Fund your account with a variety of deposit options ranging from BTC to the best DeFi cryptocurrencies and stable coins.

Ways to short crypto

The popularity of trading crypto derivatives has surged over the past few years, mainly because of platforms like Margex that give anybody interested the ability to trade crypto derivatives. Here are a few methods for shorting that you can use:

Margin Trading

Although there are many methods of shorting cryptocurrencies, the most straightforward approach is using a margin trading platform. Margin trading allows an investor to borrow money from a broker, which can result in either increased profits or losses for the investor.

Short-Selling

When short-selling cryptocurrencies, you sell them at the current price, wait for the price to decrease, and then purchase them back at a lower price.

Perpetual Swaps

Perpetual swaps allow traders to open large positions with little capital without an expiration date, meaning open positions can remain open as long as margin requirements are met. These types of contracts allow traders to use up to 100 times leverage. Perpetual swaps require a lot of liquidity to ensure that the largest orders are executed without creating slippage in the process. Margex’s aggregated liquidity, which combines multiple liquidity providers into a single order book, allows traders to use high leverage and short sell without worrying about slippage and price mismatch.

How to short crypto on Margex

Shorting cryptocurrency on Margex is a quick and straightforward process, thanks to the available user-friendly interface. These are the steps to take to short cryptocurrencies on Margex:

Register an account

To register an account, go to Margex.com and click on “Start Trading.” This will take you to a sign-up page where you will be prompted to fill in the required information.

Deposit

To make a deposit, go to the “Wallet page” and click “+Deposit.” You can deposit with a list of cryptocurrencies available by transferring from another wallet to your Margex account wallet. If you don’t have any of these cryptos, click on “Buy Bitcoin” to buy bitcoin through direct integration of Changelly.

Start Trading

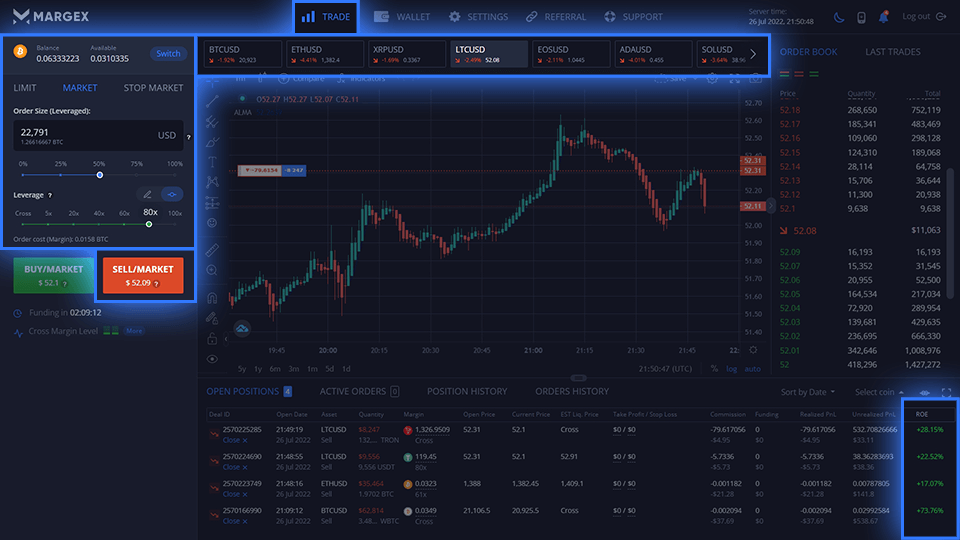

After making a successful deposit, the next step is to start trading. To enter a short position, navigate to the “Trade page.” Select the desired order parameters such as the cryptocurrency you wish to trade and your preferred order type (limit order, market order, stop market order, stop loss and take profit), size, leverage, and click SELL/SHORT. Since you are shorting, you are interested in the price of the asset falling. Once the asset has declined in price, monitor the percentage next to RoE (return on equity) and when you are satisfied with the profit on the trade, close the position to book the profit.

Advantages and risks of shorting crypto

Like everything that has to do with cryptocurrencies, crypto shorting has its rewards but it also comes with some risks. Some of these are:

Advantages:

- You only need a small amount of money to get started

- Shorting allows traders to leverage their assets

- Leverage can be beneficial if properly managed

- Crypto shorting allows traders to make profits from falling markets

Risks:

- Crypto prices are volatile

- Losses can be incurred if trades are not properly managed.

- Increasing leverage can lead to bigger losses.

- You need a margin account to short crypto.

How much does it cost to short crypto on Margex?

Margex offers the most competitive fees and the best conditions for trading. There are two types of fees charged by Margex: trade fees incurred when performing a trade and funding fees when your position is held open during the funding rollover . The table below shows Margex’s fee structure.

Maker fee – 0.019% (for LIMIT orders)

Taker fee – 0.060% (for MARKET orders)